Work with one of the top Apartment and Healthcare Lending teams, KENDALL REALTY ADVISORS have spent over twenty five years each, lending on Apartments and Healthcare

FHA 242/223(f) Hospital Refinance - No Construction Required NEW

Thursday, November 29, 2012

Tuesday, October 30, 2012

Thursday, October 11, 2012

Thursday, September 20, 2012

Thursday, September 13, 2012

Tuesday, September 4, 2012

Friday, August 31, 2012

Wednesday, August 29, 2012

Tuesday, July 31, 2012

Thursday, June 7, 2012

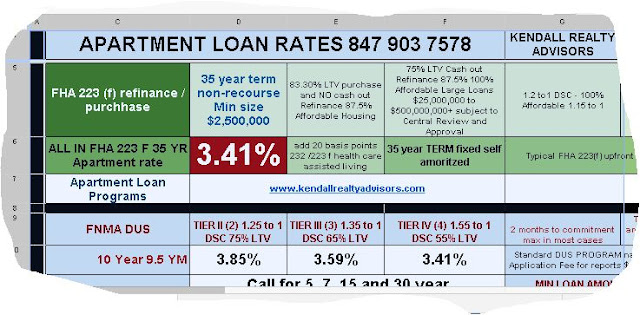

Small and Large Apartment #Lender #ApartmentLoan Pricing - #ApartmentLender #Apartment #Loan Pricing #FHA223F #FNMA

Apartment #Lender #ApartmentLoan Pricing - #ApartmentLender #Apartment #Loan Pricing #FHA223F #FNMA

RATE SHEET LINK

Wednesday, June 6, 2012

Thursday, May 24, 2012

commercial property, prices recovered to mid-2003 Levels CoStar 2012 News APARTMENT LOAN RATES LINK

APARTMENT LOAN RATES LINK

Despite a generally flat March for pricing of commercial property, prices recovered to mid-2003 levels in the first quarter as improving fundamentals and liquidity causing a broadening of the recovery into non-core commercial real estate and secondary markets, according to this month's CoStar Commercial Repeat Sale Indices (CCRSI) report.

At this rate it will be 2006 in ten short years. Oprah sells her Chicago condo for about 1/2 of what she paid. say $3,000,000 on $6,000,000 cost plus extra shoe closets.

Beyond Occupy -You can not Evict an Idea The rise of the people. The Global Revolution

Wednesday, May 23, 2012

Saturday, May 19, 2012

Tuesday, May 15, 2012

Apartment Loan rates and This Is Clearly Going To Cost JPMorgan Much More Than $2 Billion

APARTMENT LOAN RATES

Whale Ahoy

JPMorgan announced a $2 billion loss Friday. When compared to its market cap and other indicators, that goes Ouch!, but not much more. However, there’s more going on. The bank has refused to state where in its operations the loss was incurred. For good reason perhaps: the positions that caused the loss are still rumored to be open.

The main problem JPMorgan may be facing, and the 8% loss in pre-market trading may be a sign players are on to this, is that we probably already know where the loss is. A few weeks ago, the financial sphere was full of stories about the London Whale, a JPM trader in London named Bruno Michel Iksil, who had taken such massive - synthetic - derivative (gambling) positions in a 125 company index that they were moving the market itself.

Back then, some hedge funds took counter positions just for the sheer fact that he had bet so much; they figured he couldn't last forever on all trades. The underlying notion was he was long a bunch of companies; well, not a lot has gone well in the markets lately. And if you have overweight derivative positions in one direction (in this case credit default swaps) , you can make a killing or you can get punished fast and furious. He did the latter.

Read more: http://theautomaticearth.org/Finance/jpmorgan-a-tale-of-whales-and-sharks.html#ixzz1uwnfvREt

Apartment Loan rates and This Is Clearly Going To Cost JPMorgan Much More Than $2 Billion

APARTMENT LOAN RATES

Whale Ahoy

JPMorgan announced a $2 billion loss Friday. When compared to its market cap and other indicators, that goes Ouch!, but not much more. However, there’s more going on. The bank has refused to state where in its operations the loss was incurred. For good reason perhaps: the positions that caused the loss are still rumored to be open.

The main problem JPMorgan may be facing, and the 8% loss in pre-market trading may be a sign players are on to this, is that we probably already know where the loss is. A few weeks ago, the financial sphere was full of stories about the London Whale, a JPM trader in London named Bruno Michel Iksil, who had taken such massive - synthetic - derivative (gambling) positions in a 125 company index that they were moving the market itself.

Back then, some hedge funds took counter positions just for the sheer fact that he had bet so much; they figured he couldn't last forever on all trades. The underlying notion was he was long a bunch of companies; well, not a lot has gone well in the markets lately. And if you have overweight derivative positions in one direction (in this case credit default swaps) , you can make a killing or you can get punished fast and furious. He did the latter.

Read more: http://theautomaticearth.org/Finance/jpmorgan-a-tale-of-whales-and-sharks.html#ixzz1uwnfvREt

Monday, May 7, 2012

Thursday, May 3, 2012

FHA FNMA APARTMENT LOAN RATES WHEN VOTING REMEMBER #GOP #MITT #ROMNEY WANT to CLose FHA FNMA MULTIFAMILY

FHA FNMA APARTMENT LOAN RATES

ALL IN FHA 223 F 35 YR Apartment rate 4.21%

10 Year 9.5 YM 10 years 4.14% 7 years 3.94% 5 years 3.68%

ALL IN FHA 223 F 35 YR Apartment rate 4.21%

10 Year 9.5 YM 10 years 4.14% 7 years 3.94% 5 years 3.68%

Thursday, April 19, 2012

FHA Apartment Loan Programs - Fannie Mae Freddie Mac Affordable and Market Rate Multifamily Finance

FHA Apartment Loan Programs - Fannie Mae Freddie Mac Affordable and Market Rate Multifamily Finance

What Mitt Romney #GOP #FHA CLOSING MEANS TO YOU home loan health care nursing home

Mitt Romney at private fundraiser: I might eliminate HUD

If GOP hopeful The least popular nominee in eternity Mitt Romney has his way HUD will be killed and presumably so will the FHA programs. It means higher loan rates, no nursing care less rural hospitals and assisted living no aid to poor elderly mostly women for rentHome Single Family - lowest rate lender

HOME LOAN RATES GO UP 1%

HOME LOAN RATES GO UP 1%

Multifamily Loans only national construction lender rural apartment lender

Hospital - Urban and Rural Hospital loans

fewer new hospitals more rural deaths

fewer new hospitals more rural deaths

Health Care Assisted Living Nursing Home biggest lender in Country

more expensive private nursing home only option sick parents move home

It’s election season and the candidate – hoping to appeal to conservatives – wants to stick a knife in HUD/FHA because, well, it’s a cabinet level agency and cutting big government is a red meat move. But first, Romney has to get elected. And if he does, then he has to get such a move through a Congress that presumably will be controlled by the GOP. So, if you think the housing market is tough now, just wait until the FHA program disappears. Of course, I’m sure the private sector is ready, willing and able to fill the void.more expensive private nursing home only option sick parents move home

Tuesday, April 17, 2012

APARTMENT LENDER FNMA DUS LARGE APARTMENT LOAN - FNMA Small Apartment - FHA 223F: #GOP #RNC #MITT #ROMNEY PROMISE TO CLOSE FHA HUD APARTMENT HOSPITAL SENIOR HOUSING FINANCES for INVESTMENT BANKER FRIENDS

IF MITT WINS PROGRAMS DEAD SO DON't BOTHER READING OR APPLYING TO HUD

APARTMENT LENDER FNMA DUS LARGE APARTMENT LOAN - FNMA Small Apartment - FHA 223F: #GOP #RNC #MITT #ROMNEY PROMISE TO CLOSE FHA HUD APARTMENT HOSPITAL SENIOR HOUSING FINANCES for INVESTMENT BANKER FRIENDS

APARTMENT LENDER FNMA DUS LARGE APARTMENT LOAN - FNMA Small Apartment - FHA 223F: #GOP #RNC #MITT #ROMNEY PROMISE TO CLOSE FHA HUD APARTMENT HOSPITAL SENIOR HOUSING FINANCES for INVESTMENT BANKER FRIENDS

Monday, April 16, 2012

Apartment Loans Nationally $2,000,000 and up Small Apartment loans Chicago FNMA FHA and Community Banks

Apartment Loans Nationally $2,000,000 and up

Small Apartment loans Chicago

FNMA FHA and Community Banks

RATES

Wednesday, April 11, 2012

Monday, April 9, 2012

Subscribe to:

Posts (Atom)